Discover the Conveniences of Hard Money Georgia Loans genuine Estate Investors

Discover the Conveniences of Hard Money Georgia Loans genuine Estate Investors

Blog Article

Understanding the Basics of a Hard Cash Finance: What You Need to Know Prior To Using

Navigating the intricacies of hard cash car loans calls for a clear understanding of their fundamental features and implications. These finances, frequently leveraged genuine estate investments, prioritize property value over customer credit scores, offering both significant dangers and special benefits. As one considers this financing alternative, it is necessary to evaluate the advantages versus the potential mistakes, particularly regarding rates of interest and settlement terms. What essential variables should you evaluate before making such a critical monetary choice? The answers may be extra consequential than you anticipate.

What Is a Tough Cash Financing?

A tough cash funding is a kind of short-term funding safeguarded by property, normally utilized by investors and developers. Unlike standard car loans that rely greatly on the consumer's credit reliability, difficult money loans are largely analyzed based upon the value of the building being made use of as collateral. This makes them an appealing option for those that might not receive conventional financing due to poor credit report or immediate funding needs.

These financings are normally provided by exclusive loan providers or financial investment groups, and they often feature greater rate of interest prices contrasted to conventional home mortgages. The rationale behind these elevated rates depends on the raised risk that lenders assume, provided the brief duration and prospective volatility of the realty market. Tough cash loans usually have terms ranging from a few months to a few years, making them excellent for quick transactions such as property turns or immediate remodellings.

How Difficult Money Finances Job

Understanding the mechanics of hard money fundings is vital for capitalists looking for fast funding solutions. Unlike traditional car loans that depend heavily on credit report and income verification, hard money lendings are asset-based. This implies that lenders focus mainly on the value of the residential property being funded instead than the debtor's economic background.

The procedure typically starts with a car loan application, where the borrower offers details concerning the property, including its value and the intended usage of funds - hard money georgia. Upon analysis, the lender assesses the home's worth, commonly calling for a specialist evaluation. If authorized, the finance amount is typically a percentage of the residential or commercial property's worth, commonly ranging from 60% to 80%

Advantages of Difficult Cash Loans

Hard cash lendings provide several benefits that can be specifically advantageous genuine estate investors. Among one of the next page most substantial advantages is the speed at which these lendings can be obtained. Unlike conventional financing, which often involves extensive authorization procedures, difficult money car loans can be secured swiftly, enabling investors to maximize time-sensitive opportunities.

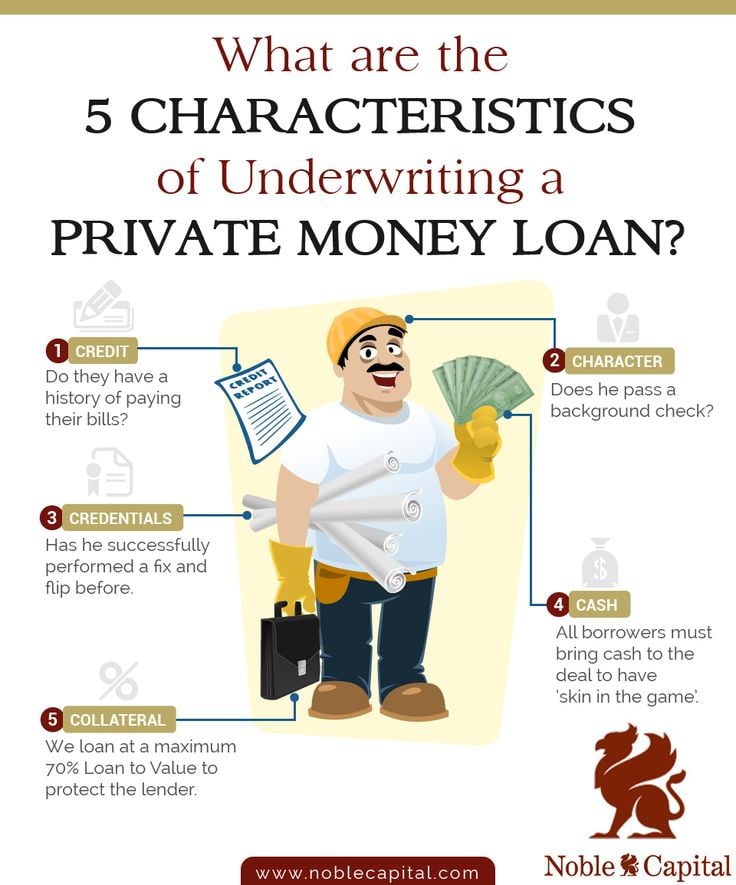

An additional benefit is the versatility in underwriting criteria - hard money georgia. Hard cash loan providers usually concentrate on the worth of the property as opposed to the debtor's credit reliability, making it simpler for investors with less-than-perfect credit history to qualify. This enables better availability to funds, particularly for those wanting to renovate or turn properties

In addition, difficult money lendings can give significant funding quantities, which can empower capitalists to embark on larger jobs. The short-term nature of these financings urges efficiency, as consumers are inspired to complete their tasks quickly to settle the lending.

Lastly, tough cash car loans can be a strategic device for financiers looking to take advantage of homes, enabling them to reinvest revenues into brand-new chances. Generally, these benefits make tough cash finances a beneficial financing alternative genuine estate capitalists navigating competitive markets.

Dangers and Factors To Consider

One considerable danger is the high-interest rates related to difficult money finances, which can vary from 8% to 15% or even more. These raised expenses can badly influence the general earnings of a property financial investment. In addition, tough cash financings often come with shorter repayment terms, generally lasting from a few months to a couple of years, calling for financiers to have a clear departure technique.

Another factor to consider is the dependence on the collateral's value instead of the consumer's credit reliability. This implies that if home values decrease or if the task encounters unexpected hold-ups, financiers may face substantial economic stress or even foreclosure.

The Application Refine

Browsing the application process for difficult cash car loans calls for careful interest to information, specifically after thinking about the connected threats. The very first step is to recognize a respectable tough money loan provider, as the high quality of your lending institution can significantly influence the regards to your loan. Research prospective lending institutions, assess their reputation, and ensure they are transparent concerning their processes and fees.

When you have actually chosen a lending institution, you will need to gather needed documents. This generally includes a financing application, building information, economic statements, and a leave strategy outlining exactly how you Extra resources intend to repay the car loan. Difficult money lenders prioritize the property's value over the borrower's creditworthiness, so a complete building appraisal is commonly called for.

Tough cash fundings usually have much shorter approval times than traditional financings, click for more info commonly within a few days. If approved, the lending institution will lay out the terms, including passion rates and settlement schedules.

Final Thought

In verdict, a comprehensive understanding of hard money car loans is vital for prospective debtors. These financings, identified by their reliance on real estate worth rather than creditworthiness, offer unique benefits such as fast accessibility to funding and versatile terms.

A difficult cash financing is a kind of temporary funding protected by genuine estate, normally utilized by developers and investors. Unlike traditional financings that count greatly on the debtor's credit reliability, difficult money fundings are mainly evaluated based on the value of the residential or commercial property being used as security. Unlike typical finances that depend heavily on credit rating scores and revenue confirmation, hard cash finances are asset-based. The very first step is to recognize a reputable tough cash lending institution, as the quality of your loan provider can considerably affect the terms of your loan. Difficult money lendings typically have much shorter authorization times than typical finances, frequently within a few days.

Report this page